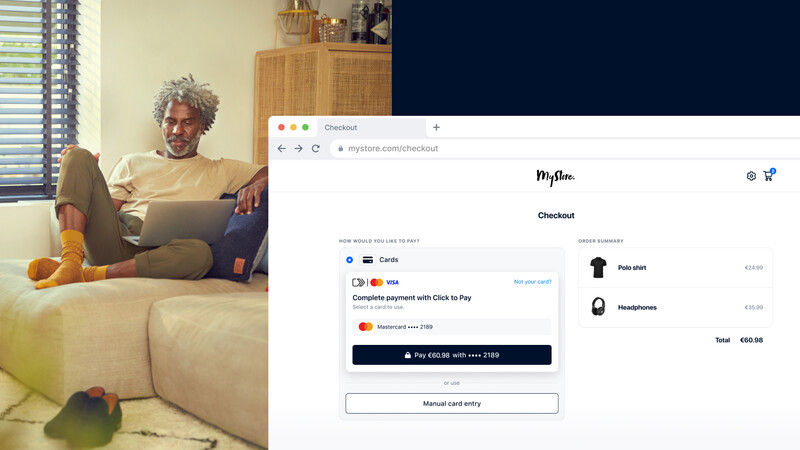

Dutch firm Adyen has embedded Click to Pay during its online checkout, removing the need for manual card entry at the payment stage.

By enabling enrolled shoppers to bypass data entry during online checkout and complete the transaction in only a few clicks, it reduces the chances that they will abandon their purchase, the company said.

“Many businesses still struggle with low conversion at online checkout, especially as it pertains to first-time or one-time shoppers,” said Edgar Verschuur, Global Head of Payments at Adyen.

“We are committed to addressing this challenge using a range of global payment initiatives. By embedding Click to Pay into our online payment flow, we eliminate the need for consumers to manually enter their card details. This makes it quicker, more intuitive, and less error-prone for shoppers to successfully complete their purchase, which ultimately drives revenue for our customers.”

Rather than manually entering card details the new function allows Adyen to retrieve a shopper’s historically preferred card information on their behalf. The resulting payment details can be used even when checking out as a guest. The company added that the feature will be accessible in all available markets.

Why is Click to Pay so popular?

Recent data shows that 68% of online shoppers still abandon their carts which leads to considerable monetary losses for retailers. While many are simply browsing, or just not ready to buy, of the remaining reasons almost one in five shoppers leave because the checkout process is too long.

Other factors include extra costs, having to create an account, slow delivery or not trusting the site with credit card information.

Another added benefit of Click to Pay is the transaction security from restricting access to customers’ card data. Instead, the data is stored on the card-issuing bank’s servers, so even retailers cannot access card details, increasing customers’ trust in the Click to pay system.