The UAE has emerged as the top-scoring ‘fintech hub’ in the MEA for the first time, according to a new analysis carried out for the 2024 Middle East & Africa Fintech Report.

The report, which has published by The Fintech Times in collaboration with Seamless Xtra, and officially launched at Seamless Middle East, last week, has revealed that UAE stands out as a leader in 2024, while Dubai in particular has emerged as a fintech hotspot, hosting an estimated half of the total fintechs in the MENA region.

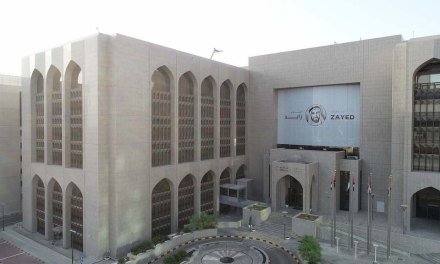

Among the breakdown of the sector, it found ‘payments, e-wallets and remittances’ to account for 39% of fintechs in UAE, followed by Insurtech (11.76%) and Lending (8.08%). With a staggering internet penetration rate of 99% and over 17 million mobile connections, the UAE exhibits a high level of connectivity and digital adoption. Additionally, Abu Dhabi has been actively investing in and promoting its fintech sector, further solidifying the UAE’s position as a leading fintech hub, the report said.

A key change in this year’s report was the ascension of Saudi Arabia and Türkiye to tier-one premier fintech hubs while Israel, historically a leader in technology has faced challenges due to the ongoing situation in Gaza. According to the report, the rise of both Saudi Arabia and Türkiye can be attributed to various government-led initiatives that have significantly impacted both wider economic development and fintech within these countries.

It also highlights multiple fintech unicorns now within these nations as well as significant VC investments (each nearing $1billion in 2023) despite it being a challenging year for global VC funding. Additionally, both now have a substantial number of fintech companies relative to their populations and compared to the wider MEA region.

See the full report here