Middle East fintech startups received funding of approximately $2 billion between 2021 and 2023, according to recent fintech research conducted by red_mad_robot.

The report finds that despite a fall in fintech investments globally, the Middle East has fared better than other regions: with total funding amounting to up to $1.5bn, with 130-150 deals and 2000 new companies established. UAE has been the most active in new investments, taking up about 40-43% of the total share, the report said.

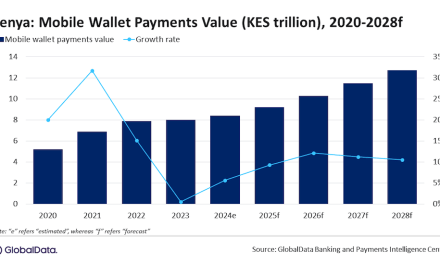

This substantial growth can be attributed to the increasing tech-savviness of consumers who actively utilise digital banking services and non-cash payment methods. Furthermore, government authorities in the Middle East, including central banks and regulators, have shown increasing commitment to the fintech sector by establishing necessary infrastructure such as accelerators, incubators, and fintech hubs.

The report not only provides market analysis but also highlights key players in the fintech market and trends within the Middle East fintech environment.

For instance, it finds that the Middle East market is dominated by companies specialising in digital payments, instant cross-border payments, BNPL, AIS and PIS products, KYC and digital banking.

Notable trends include the rise of the tech ecosystem and super apps, opportunities for fintech startups in cross-border payments and remittances, neobanking and increased potential for BNPL services.

KSA and Egypt currently account for 46% of fintech companies in the region while fintech hubs are continuing to appear in different countries reflecting the scaling of fintech in the region as it becomes increasingly attractive to foreign companies and investors.

See the full report here