Iraqi fintech ZainCash has adoped Temenos core banking and payments as it seeks to boost financial inclusion and accelerate the country’s digital transformation.

The implementation comes comes as financial institutions across Iraq ramp up the shift from legacy systems. Last month, National Bank of Iraq (NBI) announced they had adopted the system, bringing its infrastructure in line with other entities under its majority owner, Capital Bank.

ZainCash, the latest adoptee, said the move will help it expand its operations more effectively, elevate the customer experience, and quickly introduce new products. Established in 2015, ZainCash has rapidly expanded, achieving over 1.2 million app downloads, to date. Now, with the new core banking platform it is aiming to reach 3 million users by the end of the year.

With Temenos, ZainCash has brought together its core banking and payments capabilities on Temenos’ flexible, composable banking platform, which enables integration with existing internal systems, as well as with the Central Bank of Iraq. By leveraging open APIs it is planning launch a range of new services, including instant lending, as well as customised products for specific groups, such as families and students.

As well as providing access to Iraq’s large unbanked population, the increased capacity of the Temenos platform is expected to play a key role in the company’s humanitarian support for the United Nations by allowing ZainCash to deliver larger volumes of funds to refugees with increased speed, stability, and greater customization of services.

Yazen Altimimi, CEO, ZainCash, said: “Temenos’ open and agile banking platform allows us to innovate and scale at speed, delivering a world-class payment experience that meets our customers’ growing needs and expectations. With Temenos, we can more easily expand our product range and provide more personalized services as we continue to lead the way in making payments safer, simpler and more convenient for all Iraqis.”

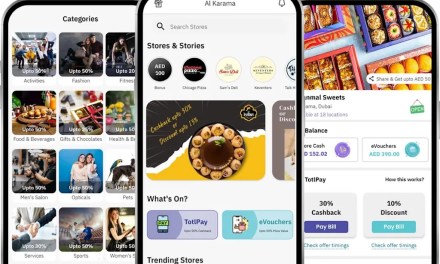

ZainCash as recently named as one of the top fintechs advancing mobile money in Iraq in 2024. Through its services, it enables users to make quick and easy local and international transfers, pay local merchants and government services, manage funds with a convenient multicurrency physical or virtual card, and access bonus features like digital vouchers.