UAE-based fintech, Hubpay has launched Hubpay Connect, a new service designed to enhance global payments integration for both financial and non-financial institutions

Hubpay Connect offers Application Programming Interface (API) integration of business platforms with Hubpay’s robust payment capabilities. This enables businesses to enhance their offerings, including for cross-border payments, managing foreign exchange and streamlining reconciliation processes.

The new solution has been designed by engineers for engineers with an ease of integration to further enhance its appeal. It comes with open API standards, auto-generation of client codes, dedicated engineering support and Slack channel, Hubpay said in a statement.

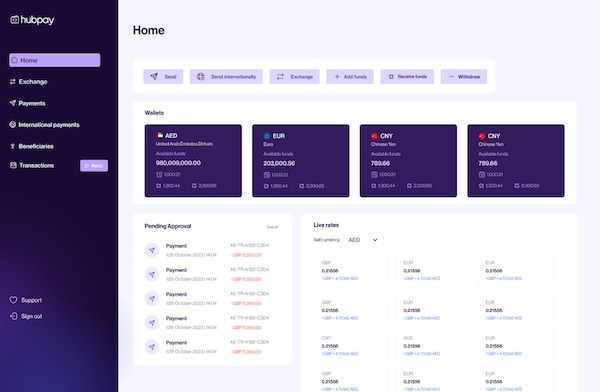

Businesses can manage both beneficiaries and recipients, access global SWIFT and local payments to more than 85 destinations, and efficiently trade SPOT FX with Hubpay Connect. Additionally, real-time wallet balance access and the ability to track pending, incoming, and outgoing funds provide businesses with increased transparency and control.

Furthermore, Hubpay Connect simplifies the process of registering incoming collections for automated reconciliation into digital wallets, and its transaction tracking functionality ensures enhanced visibility and control across wallets.

Hubpay recently became the first independently licensed company in the UAE to offer virtual IBANs. In March, CEO and founder, Kevin Kilty told Seamless Xtra that the UAE money transfer market was at a real turning point. On its latest launch, Kilty expressed excitement at offering an API solution that empowers businesses to expand their international reach and streamline their payment processes.